For centuries, people have modified Hamlet’s famous ‘To be or not to be’ soliloquy as they’ve explored important options in their lives. This thoughtful exploration often occurs when long-held beliefs have been challenged…or the ramifications are significant.

From time to time, financial markets suffer significant dislocations and challenge the ‘rules of thumb’ and ‘core beliefs’ that we typically hold. And for many investors who experience significant losses in their portfolios, they contemplate whether it might be best to simply eliminate their market exposure for a little while, avoid future losses, and re-establish their market exposure once things have returned to normal. It is fair to say that the market dislocation of 2022, where both publicly traded equities and bonds have posted significant declines over the first nine months, has many investors considering their options.

My investments are down and the market is volatile. Should I stay invested in the markets?

This is one of the most common questions investors ask, and for good reason. No one likes losing money…and the prospect of losing more can feel even worse.

Let’s explore this consideration by comparing this dilemma facing players at a casino, and why we believe the fundamental considerations in the investment world are different.

Exploring options for a late-night casino player

Most of us have spent time at a casino, perhaps playing roulette, blackjack, or a slot machine. Like investment markets, sometimes we’ll go on a run and build up some winnings. Perhaps some of us walk away at that point, pocket the winnings, and use the proceeds to buy something else. But most of us keep playing and our winnings usually erode and sometimes we start to lose some of our money. And sometimes we lose a lot of what we originally brought to the table.

So, what should the late-night casino player do after a run of losses?

If they keep playing, they might win their money back…but they might lose more.

If they walk away, they’ll crystallize their losses…is that a better choice?

Some readers might conclude that the right answer in this case is to walk away, since they never should have played in the first place. Statistically, that’s true since the overall odds are in favour of the casino. But casinos thrive around the world, primarily because the potential for satisfaction (and big winnings!) are so very appealing.

Why the casino player’s dilemma is different than market investors

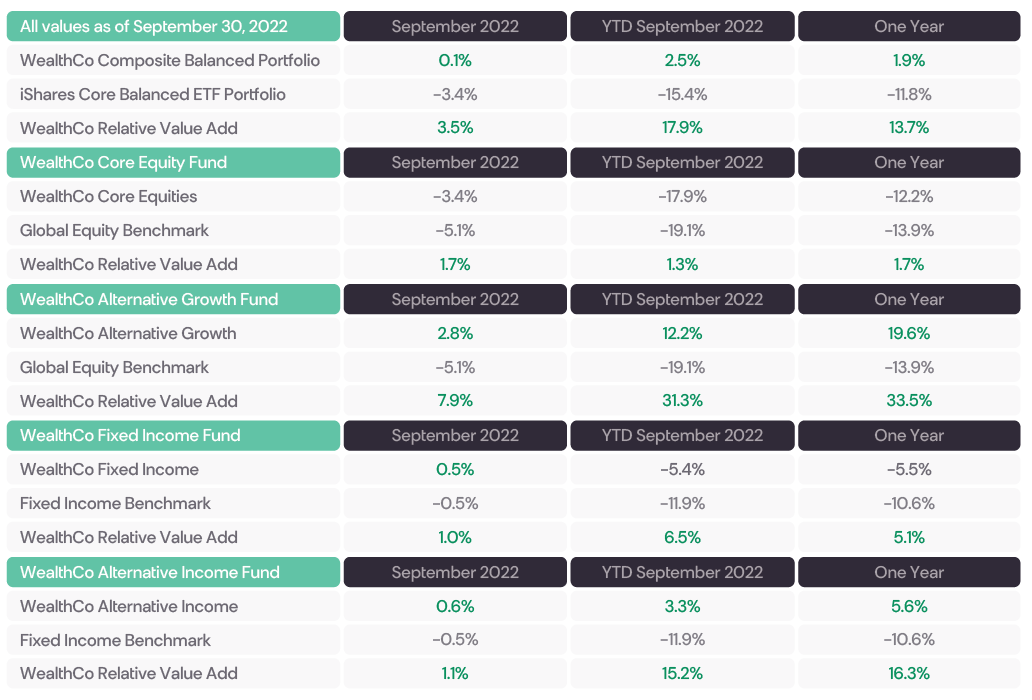

Like casino players, market investors will experience periods where their investments go on a run and increase in value. And periods where their gains erode. And periods where they incur losses. Over the first three quarters of 2022, investors who weren’t well diversified may have suffered double-digit percentage losses; a typical Canadian retail balanced fund was down more than 17% through September 30th, while the typical WealthCo balanced investor was down only about 3% - 4%.

But there are a few important differences between the casino and financial markets. The most obvious is that a casino is a game of chance with the odds in favour of the house while financial market investments are inherently structured to increase in value over the long-term.

But perhaps the most important difference of relevance to our ‘to stay or not to stay’ dilemma is the fact that the impact of ‘sitting out’ is fundamentally different:

When the casino player returns the next day, or on their next vacation, their odds remain exactly the same as they were had they continued to play to recover their losses, while

When the uncertain investor returns, their outlook for future returns will almost certainly be lower than when they exit the market.

Successful market timing is really, really hard

None of empirical evidence, academic theory, or behavioural psychology considerations support the merits of market timing. Study after study indicates that investors who decide to ‘sit out’ are much more likely to end up worse off than those who remain fully invested. And unlike the casino, academic theory supports remaining fully invested (and actually increasing market risk) in times of market downturn since relative valuations are cheaper and the long-term return expectation is positive.

The behavioral psychology component of the ‘should I stay’ dilemma is perhaps the most compelling (or frustrating depending on one’s point of view). Investors who exit the market almost always wait to return until markets have recovered well beyond the point at which they exited. They rarely lack the conviction to get back in at an even lower point. As a result, behavioural investors tend to end up with lower returns over the long term.

Our current assessment of financial markets

As we enter the fourth quarter of 2022, expectations for the broad market economy are fairly pessimistic:

High inflation remains a problem. As a result…

Expectations of further increases to short-term interest rates remain high. And as a result…

Many prognosticators expect a recession. And as a result…

Stock market values have fallen significantly in anticipation of bad news to come.

So, what does all this mean? We believe that both the bond and equity markets already anticipate an awful lot of bad news and have likely overreacted to the impact. Go-forward returns will be a function of whether the ‘news’ (i.e. how high interest rates go) is better or worse than currently expected. Will short-term interest rates rise? Yes, they will. Will we have a recession? Yes, we probably will. But unless interest rate increases are much greater than current expectations, or unless a recession is much deeper than currently anticipated, we believe that the go-forward return expectations for both bonds and equities are reasonably strong, especially over the mid to long-term. This is the typical pattern for public market returns when recessions are imminent.

So…should investors get out of the market?

As we enter the fourth quarter of 2022, our short answer to this question remains as it was early in 2022.

“We recommend that the portion of your investment account that you plan to consume/spend over the next 6-18 months have little to no market risk (i.e. invest in cash or high-quality short-term fixed income). But the portion of your investment account that has an investment horizon of three years or more be fully invested in a diversified manner with a risk profile that suits your situation.”

We don’t know what the short-term market changes will be. No one does. We do expect day-to-day volatility to continue to be high, both on the upside and the downside. We do expect both bonds and equities to recover…but like all market participants we just don’t know when that will start, and we won’t know for sure until the recovery is well underway.

We continue to believe that a portfolio with ‘real’ diversification (50% public markets, 50% diversified alternatives) remains the best path forward for longer term investors. That combination has served our investors well over the last few years, and we believe it will continue to do so.

About the Author | Dave Makarchuk

This Market Commentary is written by WealthCo Asset Management's Chief Investment Officer, Dave Makarchuk. Dave brings over 20 years of institutional investment experience to the WealthCo team as well as several credentials including CFA, FCIA, and FSA designations.

When he’s not using his critical thinking and problem-solving skills to further enhance WealthCo’s investment portfolios and improve investor outcomes, you’ll find Coach Dave on the ice, training the next generation of Canadian hockey players.

About WealthCo Asset Management

WealthCo Asset Management is a member of the Integrated Advisory Community and The WealthCo Group of Companies. The WealthCo Group of Companies works exclusively with Canadian CPA professionals and their clients through the Integrated Advisory community. With over 20 years’ experience collaborating with progressive CPA's and industry specialists, we are dedicated to working alongside our accounting partners to offer a holistic and integrated wealth planning experience to their clients. Please note, past performance is not indicative of future results.

Related Posts