Financial Planning

Market Commentary

Investment Planning

Taking a Disciplined Approach to Investing

August 23, 2021

August 2021

‘Buy low, sell high’. Four little words that are fodder for countless finance and stock market movies. The older brother of ‘always be closing’. So, given this ridiculously simplified directive to the masses to purchase stock when it is at a lower point, and simply sell it off once it peaks, how should one proceed when faced with record-high equity markets?

The approach we take at WealthCo, when faced with charts that look like the one below, can be summed up in one word: discipline.

Risk, 2021-style

Risk has an uncanny ability to keep investors up at night. 2021 risk is certainly pulling its weight, sleepless night-wise. Coming off of the first global pandemic in a century, and the economic impacts of said pandemic, the uncertainty about what the future looks like can be incredibly unsettling. Let’s not forget, one of the many new colloquialisms to emerge from COVID-19, along with flatten the curve, panic buying, and social distancing, is the new normal. Has a scarier phrase ever existed for a profession in which unpredictability has the power to deal some truly costly blows?

And then, we have the other, equally unsettling, side of the coin: comparisons of a Roaring 20’s style recovery where an explosion of pent-up demand leads to a decade of economic prosperity.

Times like these call for a disciplined approach

"

The WealthCo Asset Management investment philosophy is founded in diversification beyond traditional stocks and bonds.

That’s why, more than ever, it is critical to take a disciplined approach to investing in this new normal. Markets are expensive right now. It’s not easy to stay disciplined, but it is the best move in ensuring a healthy, long-term portfolio. Here is how to embrace a disciplined investing mindset.

Stay true to your investment philosophy…

All investment firms have an investment philosophy. A set of principles that guide their approach to investing. While it is easy to react and deviate from this philosophy due to erratic market conditions, this philosophy was established for a reason and should be honoured.

The WealthCo Asset Management investment philosophy is founded in diversification beyond traditional stocks and bonds. Key deliverables include:

- Enhanced diversification;

- Reduced volatility;

- Capital preservation; and

- Adequate cash flow.

...while considering the current environment

Entry multiples are high. Exit multiples are in current stress, thanks to lower profit margins, rising inflation, and the risk for increasing interest rates. This is a reality of the current environment and should be taken into consideration for strategic investing.

Our disciplined approach involves affiliating with partners who place a strong emphasis on buying the right companies and backing the right management teams as well as investing in sectors with strong earnings growth.

Seek out diversification

Diversification is a major component of the WealthCo investment philosophy. With the tremendous opportunities available through our structured investment pools and our access to world-class partners, the traditional 40% bonds and 60% stocks portfolio just doesn’t cut it for us.

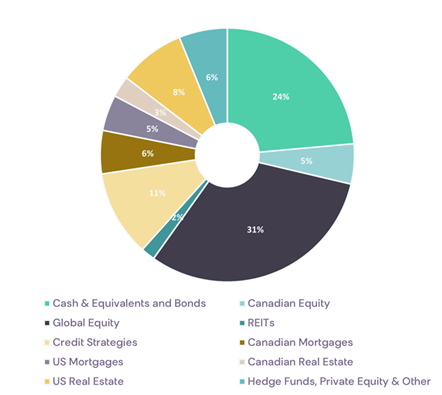

WealthCo Balanced Portfolio | August 2021

We endeavor to protect, preserve, and grow wealth through a meaningful allocation to alternative investments.

- Like Bumble. Yes, we are invested in the female-driven dating application that empowers women to make the first move with prospective romantic connections. Discipline also applies when it comes to selling shares because valuations are high, which we have done, while also continuing to hold some since we believe in them in the long run.

- Like Chicago Data Center, which is the first asset in the Digital Real Estate Fund. With tremendous growth being experienced globally in data consumption, data centers are an attractive investment. This one is even more so given its proximity to population, low natural disaster risks, access to fiber connectivity, and ability to add more capacity as demand increases over time.

- Like Forest Logistics, an Asian logistics property development and operating platform. With a resilient strategy (one that has benefitted from COVID-19 and the increased demands for space brought on by an accelerated transition to e-commerce), and a stabilizing portfolio of ten existing sites, this fits within our criteria.

Related Posts