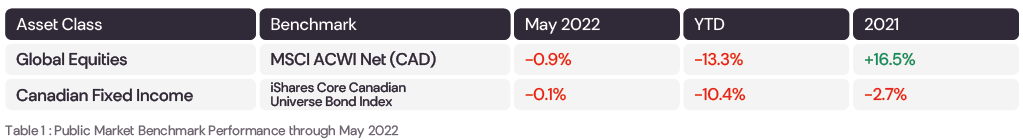

Financial market uncertainty and volatility continued to dominate headlines last month with both our public equity and fixed income benchmarks finishing slightly lower for the month.

As a result, many Canadian investors, particularly those without exposure to alternative asset classes, are seeing reductions in the value of their assets of over 10% through the end of May and further losses through the first two weeks of June. Such performance can be particularly frustrating when inflation has risen as rapidly as it has in recent months.

How have WealthCo’s funds performed recently?

We are pleased to report that WealthCo’s emphasis on downside protection and portfolio diversification (recall last month’s Market Commentary) has resulted in overall relative performance during 2022 that is well above benchmark performance. Furthermore, both of our pooled funds, which emphasize alternative asset classes, have posted positive year-to-date returns.

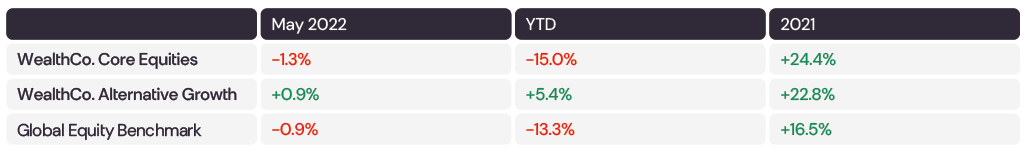

WealthCo’s Growth-oriented Funds

WealthCo’s Core Equity Fund

WealthCo’s Core Equity Fund is sub-advised by Laurus Investment Counsel and Dixon Mitchell. Laurus manages allocations to Canadian equities, US Small Cap equities, and global equities. Dixon Mitchell manages US Large Cap equities.

Together, Laurus and Dixon Mitchell posted very strong results in 2021, with the aggregate fund outperforming our global equity benchmark by nearly 8%. Our Laurus allocation to Small Cap equities performed particularly well while our Dixon Mitchell allocation also added value.

Through May 2022, aggregate performance has been below benchmark, with the WealthCo fund underperforming our global benchmark by 1.7%. The allocation to Global Small Cap equities has significantly underperformed primarily due to its European exposure (which has been significantly impacted by the Russia/Ukraine conflict). The relative performance of our Canadian equity allocation has also been disappointing and is primarily a result of its underweight to Canadian energy companies.

Overall, while we are disappointed in the most recent 2022 underperformance, we note that over the last four years to May 31, 2022 this fund has outperformed its global benchmark by 0.3% per annum (after fees). We will be evaluating the overall allocation to this fund over the next few months. As the fund continues to grow, opportunities to further diversify the portfolio will emerge.

WealthCo’s Alternative Growth Fund

Similar to many of Canada’s largest pension funds (such as the Canada Pension Plan), WealthCo’s Alternative Growth Fund features diversified allocations to real estate, private equity, and infrastructure. The fund is sub-advised by 12 independent investment managers, often via a Limited Partnership structure. Limited Partners (LP’s) can access investments that are not typically available to individual retail investors on a diversified basis.

Through May 2022, aggregate performance has been strong, with the WealthCo Alternative Growth Fund outperforming our global equity benchmark by 18%. Solid results have been posted across the portfolio, with aggregate gains reported across many of our Real Estate, Private Equity, and Hedge Fund investments. While modest writedowns have been recognized on certain assets, they have had limited impact on overall performance due to our broad diversification. Alternative Growth posted strong performance in 2021 as well, outperforming our global equity benchmark by 6%.

As part of our ongoing due diligence process, we are regularly in contact with our investment partners as we, and they, assess the impact of rapid inflation and the threat of recession on the portfolio. While inflation will certainly challenge some businesses more than others, in most cases it appears that our underlying businesses are well positioned with relatively strong balance sheets and cash positions.

Overall, we have significantly repositioned this fund over the last few years. Most of the legacy investments from the fund’s early days have been divested and the fund’s small allocation to Hedge Fund investments will be divested at the end of Q2 2022. Going forward, we anticipate increasing the fund’s allocations to Infrastructure and Private Equity investments more so that to Real Estate. While many of our Real Estate investments have performed well, future further diversifying of the portfolio until the overall allocation to Real Estate is less than 40%, will be a priority.

WealthCo’s Income-oriented Funds

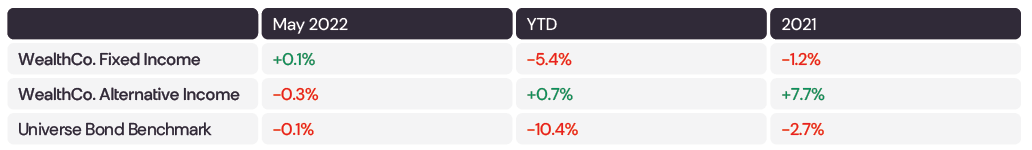

WealthCo’s Fixed Income Fund

WealthCo’s Fixed Income Fund features allocations to investment-grade fixed income investments issued by the government of Canada, provinces, corporations, and government-backed agencies. All bonds are denominated in Canadian dollars.

While the primary objectives of the three other WealthCo pools focus on return enhancement, the primary objective of this fund also emphasizes capital preservation. The overall duration of this fund has been relatively short compared to its benchmark to protect against significant losses of value should interest rates rise rapidly.

Through May 2022, the relative performance of the fund has been well above benchmark, with the WealthCo fund outperforming its benchmark by 5.0%. Relative performance for 2021 was reasonable as well, with the WealthCo fund outperforming its benchmark by 1.5%.

We will transition sub-advisory responsibilities for the WealthCo fixed income fund to Fiera Capital Management over the next month or so. We are confident that Fiera is very well suited as an investment partner and that they will continue to balance the pursuit of capital preservation with income generation.

WealthCo’s Alternative Income Fund

WealthCo’s Alternative Income Fund features diversified allocations to alternative credit mandates including various forms of Corporate Debt and mortgages. The fund is sub-advised by 14 independent investment managers including several Limited Partnership structures.

Through May 2022, aggregate performance for the Alternative Income Fund has been relatively strong, with the WealthCo Alternative Income fund outperforming our fixed income benchmark by 11%. Unlike most public market bond investments, most of the interest rate exposure within the Alternative Income Fund is of the ‘floating rate’ variety, and therefore the rapid rise in interest rates which we have seen in 2022 hasn’t had a significant impact on the value of the fund’s investments. Alternative Income posted strong performance in 2021 as well, outperforming our fixed income benchmark by 10%.

As part of our ongoing due diligence process for Alternative Income, we are regularly in contact with our investment partners as we, and they, assess the impact of rising rates and the threat of recession on the portfolio. Rising rates increase the returns on many of our portfolio investments but can also encourage some borrowers to re-finance earlier than anticipated or threaten their ability to repay. We will be keeping a close eye on the underlying portfolio as monetary policy continues to evolve.

Summary

We remain committed to broad diversification across asset classes as outlined in our ‘Evolution of Investing’ video.While we are pleased with the relative performance of the portfolio over the last little while, we certainly cannot rest on our laurels. The road ahead will remain uncertain, particularly if the Russia/Ukraine conflict extends and inflation remains high. We anticipate continuing to direct future investments to sectors which we expect will thrive in a higher interest rate environment while continuing to emphasize diversification.

Related Posts