The business world has been abuzz with the following the Rogers family drama these past couple of months. And it’s easy to see why: it has it all. A bitter family feud complete with mud-slinging? Check. Social media drama? Check. Corporate power struggles? Check. A $26 billion takeover in the works? Check. An ill-timed (and incredibly ironic given the nature of the Rogers business) butt-dial? Check.

The Coles notes version of this intriguing story is as follows:

- Ted Rogers, founder of Rogers Communication, passed away in 2008, leaving behind his wife Loretta and four children (Lisa, Edward, Melinda, and Martha)

- The remaining Rogers family members own 97.5% of Rogers shares through the Rogers Control Trust, of which son Edward is the chair

- Earlier this fall Edward undertook a campaign to oust company CEO Joe Natale, a plan that came to light during the aforementioned ironic and ill-timed butt-dial

- Following this revelation, the board (including Edward’s mother and sisters) voted to remove him as Rogers company chair

- In response, Edward in his role as chair of the Rogers Control Trust, replaced several board members who then reinstated him in his original role; a move that the Supreme Court has ruled in favour of

Like so many others, WealthCo’s Vice President of Insurance and Estate Planning, Jeff Dyck, has been watching the drama unfold with fascination.

“Family drama rarely occurs at a convenient time – but the timing of this couldn’t be worse. Rogers Communications Inc. is in the middle of a $26 billion takeover of Shaw Communications Inc. - a massive undertaking requiring dedicated focus and attention – when family dynamics and discord abruptly cause a distraction. Rogers Communications, while publicly-traded, is controlled by the Rogers family which owns 97.5% of the common voting stock through a trust. Ted Rogers founded and guided the company for 50 years, taking it from a small regional player to a national powerhouse. When he passed away in 2008, his will left structures in place that would provide guidance on how the family would continue to operate the company. His intention was of grand design and worked well for a long time, for 13 years.”

Aside from the juicy headlines, there are some real, tangible, what-not-to-do family business takeaways to consider.

Make your intentions crystal clear

Can’t-look-away drama aside, this story is a sad one for the Rogers family. Ted Rogers threw his heart and soul into building his company and, understandably, wanted to preserve the legacy he spent his life building. It’s safe to say, this messiness wasn’t what he had in mind.

“As a founder, you have specific ideas and intentions on the continuity of the family business and they should be clearly stated and communicated to the family. If not communicated verbally, these intentions need to be clearly outlined in a unanimous shareholders agreement or a will. Otherwise, your intentions are simply a wish and nothing more,” Dyck points out. “In the case of the Rogers family, the formality of the Rogers Control Trust was in place. However, a statement of intentions, created in 2008, has just been made public. As it is not a formally executed document, it effectively has no bearing.”

Business founders work hard to build their legacy. And they need to take the proper precautions, in tandem with their financial and estate planning team, to ensure this legacy is protected for generations to come.

“I’m often amazed at how many people start preparing their shareholders agreement or their will, but don’t finish the job. These documents often end up in a drawer to deal with on another day…but what if that day doesn’t come? Death rarely comes at a convenient time. If intentions are not documented properly, assumptions can be made and lawsuits may enter the picture. Everyone has their own way of interpreting the intention behind the document. If we can assist the family in clarifying, communicating, preparing, and executing their intentions, guesswork is eliminated and potential conflict among heirs is mitigated.”

Clear governance is a must-have

“When you have a powerful mother, a powerful son, other family members and considerable wealth without an absolutely fantastic governance structure, it wasn’t a matter of if there were going to be problem, but rather when,” Dyck states.

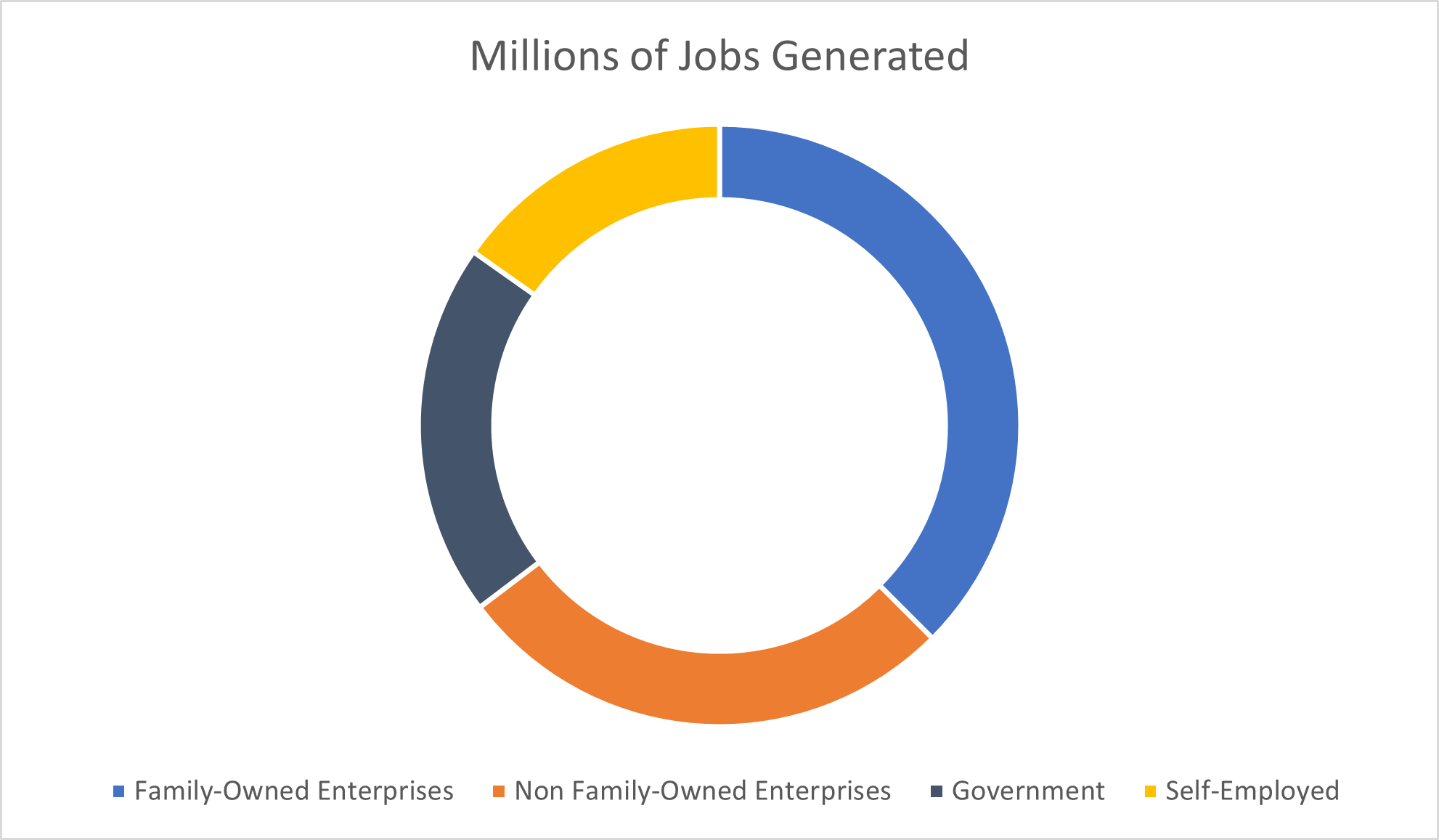

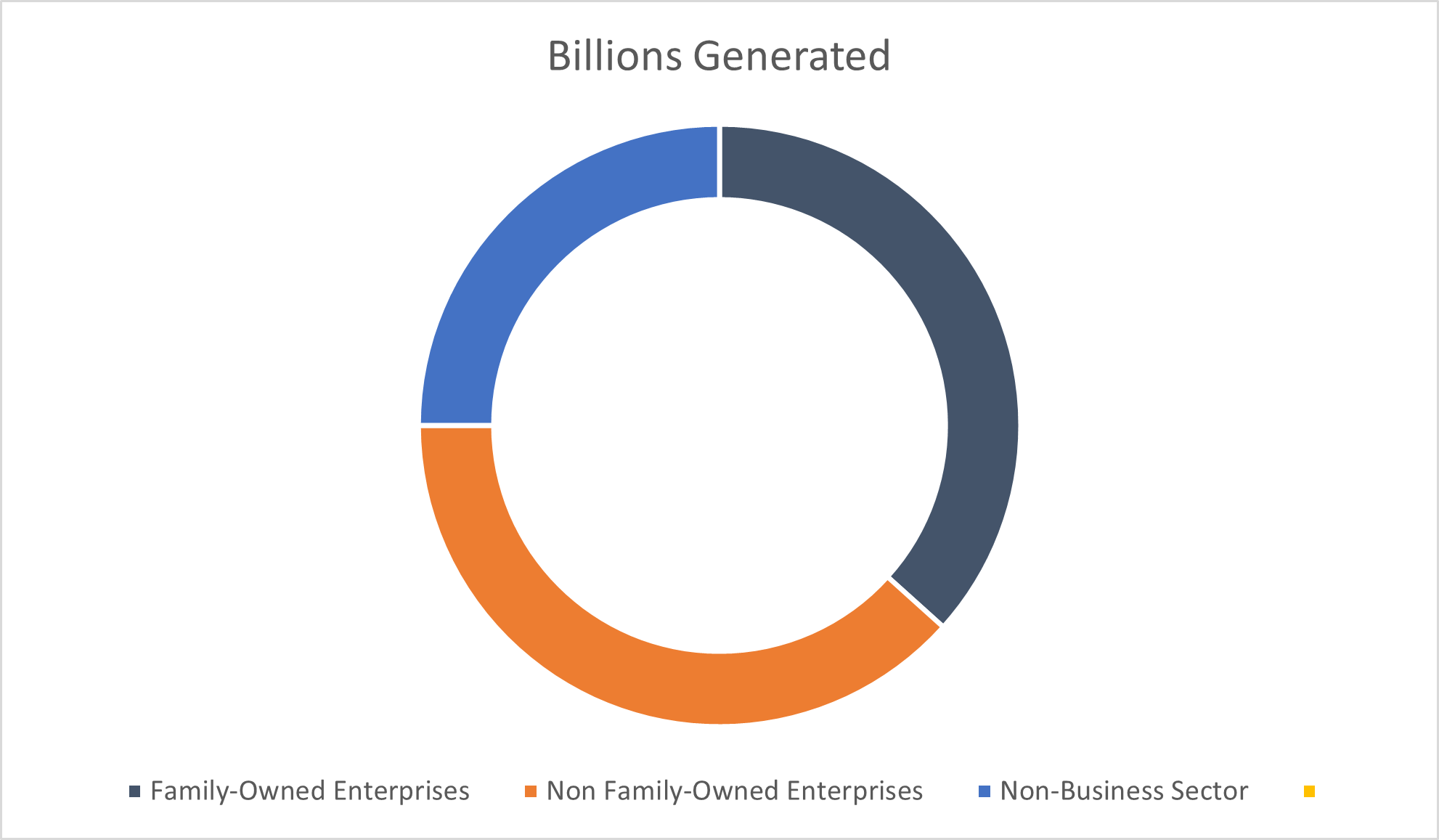

Family-owned enterprises have tremendous impact in Canada. The Conference Board of Canada reports that these businesses:

- Generate almost half of Canada’s private sector real gross domestic product (equating to $575 billion);

- Are responsible for employing almost 7 million people across the country (equivalent to 46.9% of private sector employment); and

- Are found in all industries however are most prominent in agriculture.

Family-owned businesses are vital to our economy and need to take steps to ensure their ongoing health – including solid governance planning.

As Dyck points out, “if there isn’t really solid governance in place it leaves wiggle room – which makes things like handpicking the CEO and the Board of Directors - possible. It’s unusual not to have an independent board, when everything is tied so closely back to the family. Not having this in place can create the kind of conflict that we are seeing now with Rogers Communications.”

Involve family members early on

Ensuring that all family members are in alignment on the family and organizational values, purpose, and priorities, while understanding that these may evolve over time, provides a solid foundation for continuity planning.

“Another definite takeaway is to be very clear in continuity planning regarding scope. Clearly identify the role each family member plays; within the family, within the company, or in both places,” Dyck cautions. “Identify when a family member has the option to become a shareholder and when family members may begin to participate in business meetings. There should be a learning process with younger family members to ensure they have an understanding of the business, how it works, why it works and who does what. Most importantly, the younger generation should understand that becoming part of the family business is not an obligation nor a right. It is an option, if they should choose and if they are qualified. This will ensure the greatest chance of success in keeping the business in the family for multiple generations.”

One of the many value-adds of WealthCo’s Integrated Advisory approach is our ability to bring in partners through our network, experts who bring in these extra layers of specialized expertise. Reach out to a member of your Integrated Advisory team today to start the important discussion on succession planning and protecting your family-owned business.

Related Posts