Sadly, the Russian invasion of Ukraine continues to dominate the headlines. After seven weeks of the conflict over 10 million Ukrainians have fled their homes (according to the United Nations), and the World Bank is predicting that Ukraine’s economy will shrink by over 45% as a result of the invasion.

On the financial markets front, equity market performance since the February 24th invasion has been reasonably robust. The Canadian S&P/TSX composite index has yet to dip below it’s February 23 closing price and is 5% higher as of April 19th. Even the MSCI ACWI, which tracks global equity-market performance across 23 developed countries and 25 emerging markets, has held strong, only briefly dipping slightly below its February 23rd closing price of $686.23 in mid-March and as of April 19th is up 2.3%.

The Bond Market is Doing What?!?

Without question, the biggest financial market story of the quarter is the rapid rise in inflation and the reaction of the public bond market. Bond yields around the world have been rocketing up at a very rapid pace and bond investors have seen significant declines in the values of their portfolio.

This is particularly headline-worthy since…we’re talking about bonds. Aren’t bonds supposed to be the predictable and safe ‘Steady Eddie’ in most portfolios? Canada’s bellwether bond benchmark, the FTSE/TMX Universe Bond index, posted a loss of 7.7% in Q1 2022. And this followed a loss of 2.7% in 2021. Short-term losses of over 10% are frustrating for any asset class…but particularly for one which investors have come to rely on as a safe, steady stream of income with limited volatility.

This lost value in fixed income is frustrating for many investors, particularly conservative investors who specifically chose to invest heavily in the bond market because of its stable reputation. In the interest of better understanding exactly what is going on with the current bond market, we posed a few questions to WealthCo’s Chief Investment Officer, Dave Makarchuk.

Q: Aren’t bonds supposed to be the ‘safe’ asset class?

Yes, bonds are definitely considered to be one of the safer investment classes…and they still are. Unlike equity investments, an investment in a publicly traded bond typically provides a contractual obligation for a regular interest payment (often referred to as a ‘coupon’) as well as a return of principal (the original investment) when the bond matures. And bonds are typically secured by the assets of the issuer (generally the taxation ability of a government or the assets of a corporation).

Q: So how can bonds lose value?

Publicly traded bonds can lose value for two primary reasons:

- A decrease in confidence that the issuer of the bond will be able to continue to pay regular coupon and the eventual principal repayment (default risk), and/or

- The market price of a bond is inversely related to changes in interest rates; in other words, as rates increase, prices decrease. The value of promised coupon and principal payments of existing bonds declines as newly issued bonds start to offer higher yields, exposing current investors to what we call interest rate risk.

There are other factors that might impact the value of a publicly traded bond (such as illiquidity risks), but these are the two biggest reasons.

Q: So why have bonds lost so much value…and so quickly?

Expectations of rapidly rising interest rates have undoubtedly been the primary reason that bonds have lost so much value over the last year. The reduction in value has not been because of a decrease in confidence that issuers will be able to continue to make payments (other than perhaps very unique situations where one’s core business, or economy, like Russia, is under stress).

Q: Is this a uniquely Canadian problem? Or global?

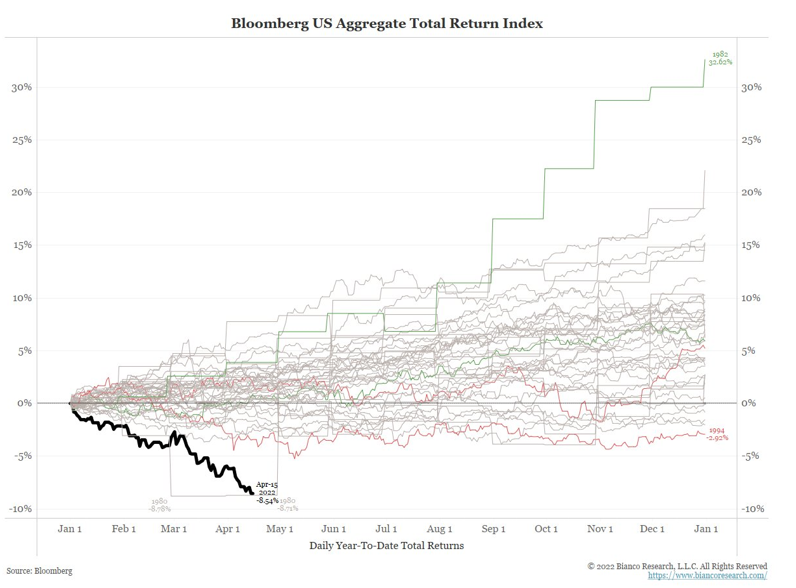

Canada’s bond market challenges are mirroring those of the global marketplace. Bloomberg’s US aggregate bond index’s losses are very similar to those of Canada, while losses in Europe and emerging markets are even higher. Interest rates are rapidly rising around the world!

Q: So why are interest rates rising, and bond values falling, so fast?

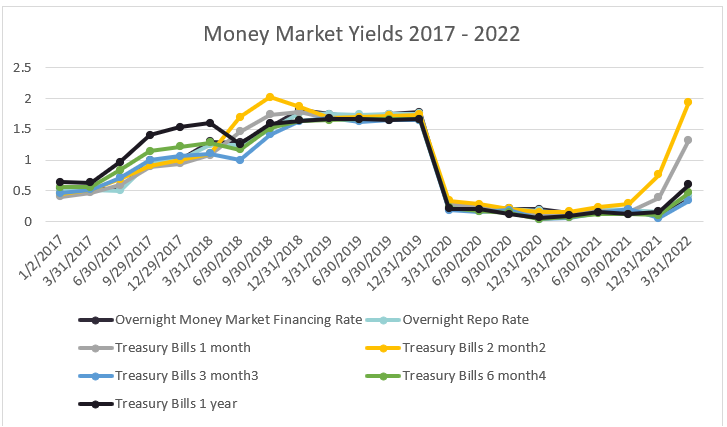

The rapid rise in interest rates that we are seeing trace back to the initial COVID crisis in Q1 2020, when central banks cut short-term interest rates rapidly and deeply to stimulate the economy. Much lower interest rates encourage people and businesses to borrow more money. The stimulus was slow to take hold (since the impact of COVID was so uncertain) but borrowing began to increase.

Interest rates remained at their ultra-low level throughout 2020 and 2021 despite evidence that global economies were heating up. Even though unemployment was falling to record lows, housing prices were soaring, and supply chain problems were emerging, central banks were reluctant to raise rates as COVID waves continued to emerge. The uncertainly that Omicron caused in December 2021 further delayed the inevitable first increase in rates.

Shortly after the calendar turned to 2022, the ‘Perfect Storm’ emerged with a vengeance for the bond market. Inflation fears began to rise quickly while COVID concerns began to diminish. Governments around the world sensed an opening and began to clearly signal that rate hikes would begin soon and would continue throughout 2022. Russia’s invasion of Ukraine further exacerbated a tenuous situation as energy prices rocketed higher.

Markets quickly reached a consensus that rates would continue to rise in the short-term and bond values began their free-fall. Inflation concerns grew larger as energy prices rose quickly.

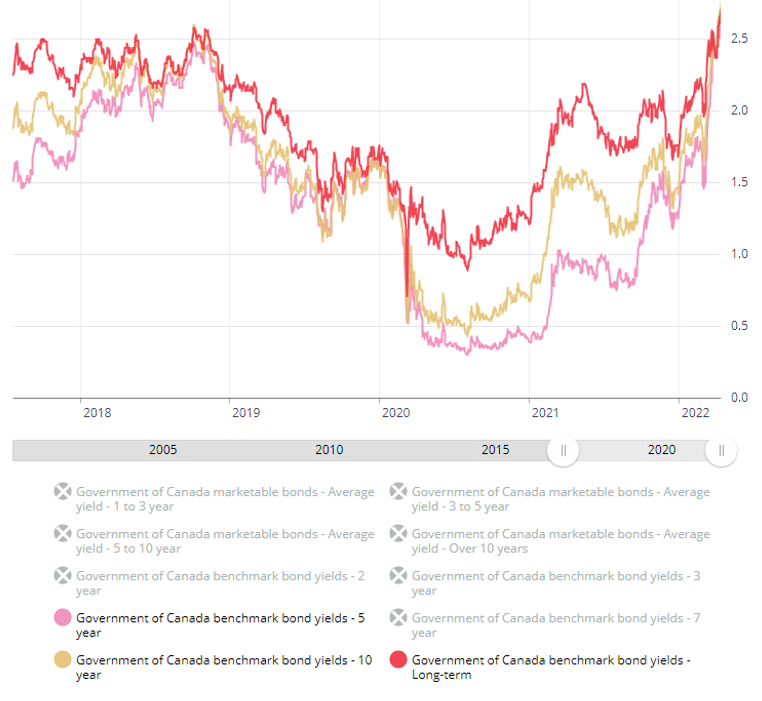

Q: Will interest rates continue to rise?

Interest rates continued to rise in early April 2022, bringing benchmark Canada yields back to where they were in the fall of 2018. They haven’t been measurably higher than today’s rates since 2011 … over 10 years! While it is plausible that they continue to rise in the short-term, it is also plausible that they level off, and eventually begin to decline, once we see evidence that inflation is coming under control. While it is difficult to see a silver lining at this point in the cycle, the return to higher yields will eventually bring higher overall returns going forward.

Q: How has WealthCo positioned its fixed income portfolio?

A: WealthCo’s fixed income portfolio continues to emphasize capital preservation while striving to deliver regular and consistent investment income. The duration of our portfolio continues to be significantly shorter than that of the broader universe (4.2 vs. 7.9 at March 31st). Duration measures the price sensitivity of a bond portfolio, and our positioning and has significantly helped our performance relative to the benchmark:

Q: How has WealthCo’s alternative fixed income portfolio performed?

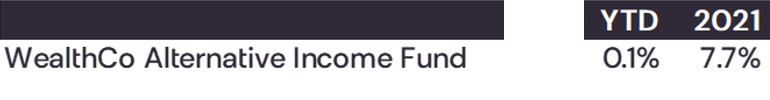

A: Our Alternative Fixed Income pool invests in a diversified portfolio of mortgages, private corporate debt, and other high yield fixed income investments. The duration of this fund is very short and accordingly its relative performance has been very good:

Q: How would you summarize your outlook for your fixed income funds?

A: Our Core Fixed Income fund yields just under 3%…and that’s a reasonable expectation for mid-term annualized returns on a go-forward basis. However, it’s likely that choppiness will continue until inflation comes under control and that short-term returns will disappoint. Our Alternative Income targets returns of 5-6% per annum over the long-term and we believe that continues to be a reasonable expectation. Alternative Income’s return drivers are different than the Core Fixed Income fund, so we continue to recommend a diversified holding of both portfolios for all of our investors.

Related Posts