Investment Planning

General Interest - Personal

Growth of the Sustainable Investing Movement

November 26, 2021

In our recent article on Millennial Investment Trends we touch on several notable trends that we have seen with this influential demographic, including higher debt loads, the rise of cryptocurrency, and adoption of retail investment apps. Also, a growing trend with millennials? Sustainable investing practices.

Recent statistics point to Environmental, Social, and Governance (ESG) investing as being less of a passing fad and more of a true paradigm shift, and one with significant staying power. Consider the following:

- $3.2 billion flowed into Canadian-based ESG funds last year;

- Total net assets in ESG funds increased by 37% from 2019 to 2020 (bringing the total to $22 billion);

- While only 71% of investors were interested in ESG investing in 2015, this number grew to 85% in 2019; and

- This interest is more pronounced among millennial investors, with 95% indicating an interest in ESG investing.

“ESG has become mainstream and is front of mind for many investors, including ours,” WealthCo Chief Operations Officer Sophie Blais states. “Many of our investment partners are making head roads in establishing and using ESG criteria when making investment decisions.”

What is Behind the Heightened Demand for ESG?

There are several driving factors behind the growing demand for ethical and responsible investing.

Increasing Consumer Demand

“The demand for ESG is due to investors wanting to invest on a conscious basis – to make sure their investment dollars go towards supporting companies aligned with their values,” Blais shares. “For example, 83% of millennials say environmental sustainability is extremely important.”

Consumers are demanding environmental and socially conscious business practices from their goods and services suppliers more than ever before. And they are willing to pay a premium for these business practices. Some of the business practices on their radar according to a recent PWC report include:

- 57% of consumers believe that organizations should do more to advance environmental issues, including climate change and water stress;

- Governance issues, including gender equality – 54% believe there needs to be more progress in this area; and

- Social issues such as diversity and inclusion and data security, where 48% of consumers are looking for further progress.

Government Investments in ESG

The Canadian government made some lofty promises at the UN Climate Conference of the Parties (COP 26) in Glasgow earlier this month. Among these promises? A commitment to phase out coal-fired electricity by 2030, a pledge to cut 2020 methane emission levels by 30% in the coming decade, and steps towards net-zero emissions by 2050.

Lofty promises like these are going to require substantial government investment in order to come even close to delivering on., including the $3 billion Net-Zero Accelerator Fund that the federal government announced last year.

Increased Regulatory Focus on ESG Reporting

As the demand for ESG investing has continued to increase, the interest of regulators has been peaked. And they are taking steps to ensure that investors have access to the information they need. Here is some recent evidence that this is being taken seriously by the industry on a global scale:

- Ontario’s Capital Markets Modernization Task Force issued a report last January that recommended mandatory ESG disclosure for all non-investment fund issuers that complies with the recommendations of the Task Force on Climate-Change Related Financial Disclosure

- This same report called for the Canadian Securities Commission to impose a uniform standard across all provinces

- In April, the European Union began rolling out a mandatory ESG disclosure regime which includes screening criteria for actions that support climate change adaption and mitigation

Source: ESG continues to take centre stage in securities regulation in Canada and abroad | McCarthy Tétrault

How is ESG Assessed?

Not unlike with a personal credit score, organizations are assigned an ESG score based on a variety of perceived factors. There are several reporting agencies that calculate ESG scores using a wide range of methodologies. While each methodology differs, some of the behaviors and considerations analyzed may include:

- Corporate policies (anti-discrimination, environmental)

- Community involvement

- Compliance with government environmental regulations

- Commitment to employee working conditions

- Transparency with accounting and reporting

- Human rights practices

- Product safety

“ESG criteria can be positive and negative for a company,” Blais shares. “It can impact shareholder value and performance.”

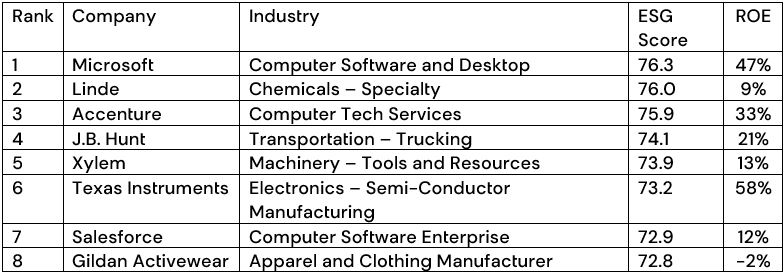

Top Eight ESG Companies

Investor’s Business Daily (IBD) publishes an annual list of the 100 Best ESG Companies of 2021. In determining who made the cut for the 100 Best ESG Companies of 2021, IBD screened data for more than 6,000 companies that are listed on the Dow Jones. Details on the top eight are listed below.

To learn more about ESG and the growth of the sustainability space, check out our Innovative Accountant podcast episode featuring guest Todd Coakwell, Senior Director of Sustainability and ESG Disclosure with Nutrien.

Note: this article is part of our four-part series on Millennial Investment Trends. Check out the other articles in the series:

The Great Wealth Transfer: Is Your Family Ready?

Related Posts