For many new employees, when considering a new job offer the benefits package factors heavily into their decision-making process. One of these benefits tends to be life insurance coverage. A recent survey reveals that 62% of Canadians with life insurance have employer-supplied coverage. For over half of that 62%, however, this coverage is their only coverage. Which begs the question, is this amount of coverage sufficient to meet the needs of most employees?

Usually not, according to Michael Munro, Associate, Insurance and Estate Planning with WealthCo. “As a general comment, it’s unlikely the group coverage is adequate. For a student fresh out of university, without student loans, it’s probably enough. But in most cases life insurance is likely not even on their radar at this stage of their life. However, for the average worker who is between 30 and 60, it’s likely only a portion of what they need. Most people don’t fully understand what their life insurance needs are because they have never gone through the exercise of sitting with a financial professional and having a broader conversation about their future.”

Why It’s Risky to Rely Solely on Employer-Provided Life Insurance

“For starters,” Munro points out, “the coverage is only in place as long as you are an employee.”

As Canada’s gig economy continues to grow and more individuals explore contractor-type arrangements with employers, finding a way to meet life insurance needs should be top of mind for these workers.

Furthermore, if one must leave their job due to a medical condition, getting replacement life insurance may prove to be difficult – and at a time when your family needs it most.

What is the Optimal Amount of Life Insurance One Should Have?

“The rule of thumb for coverage amount has traditionally been, ten times your annual income,” Munro explains. “Quite frankly I think that estimation was put in place because a proper needs analysis hadn’t yet been undertaken. Nowadays we have better tools in place to really assess what the right amount is based on you and your family’s individual needs.”

WealthCo takes a three-step approach to insurance:

- The first step involves a candid conversation to identify the impact that death, disability, or illness would have on your family’s financial needs, taking into account your full financial situation, this includes savings, insurance, and group benefits.

- Secondly, we work together to identify and prioritize risks and provide solutions.

- And finally, we put together a plan on how to best manage your risks.

“People are living so much longer these days,” Munro points out. “If you can tell me exactly when you are going to die, I can tell you exactly how much life insurance you need. But without a crystal ball, you really can’t. Hence why these tools and processes are so critical.”

PolicyMe reports that group life insurance is typically worth only one- to two-times an individual’s yearly salary (with coverage coming in between $54,630 and $109,260 based on the average Canadian salary).

Ensuring You are Covered

What is the best way for someone to determine whether their existing coverage is sufficient for their family’s needs?

“Step one is to have a conversation with an insurance expert,” Munro recommends. “Someone who is willing to have that broader conversation, someone who understands how to best mitigate your risk, someone who won’t sell you something that isn’t a fit.”

This is where WealthCo’s Integrated Advisory approach comes in. By working with your trusted accountant, we bring a holistic lens to growing and protecting your wealth and achieving your financial goals. Reach out today for a personal risk review.

Case Study: Meet the Forrester's

Seeing is believing, so we’ve pulled together a fairly standard mock scenario based on a couple, oh, let’s call them Chris and Jennifer Forrester. Chris is a junior high teacher, who earns $67,000 annually and Jennifer is a graphic designer who brings in $110,000 per year, bringing their total annual household income to $177,000. Chris and Jennifer are both 37 years old, and they have three children (aged five, eight, and twelve).

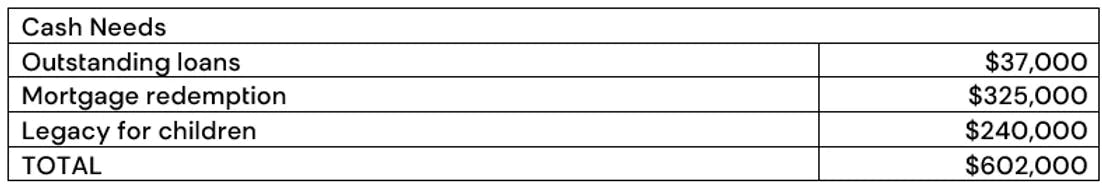

The Forrester’s owe $325,000 on their mortgage and are chipping away at a $37,000 car loan.

How much coverage should the Forrester’s ideally have in place to ensure their children are protected in the event that something happens to them? Their WealthCo insurance advisor considered several factors in working with the Forrester’s.

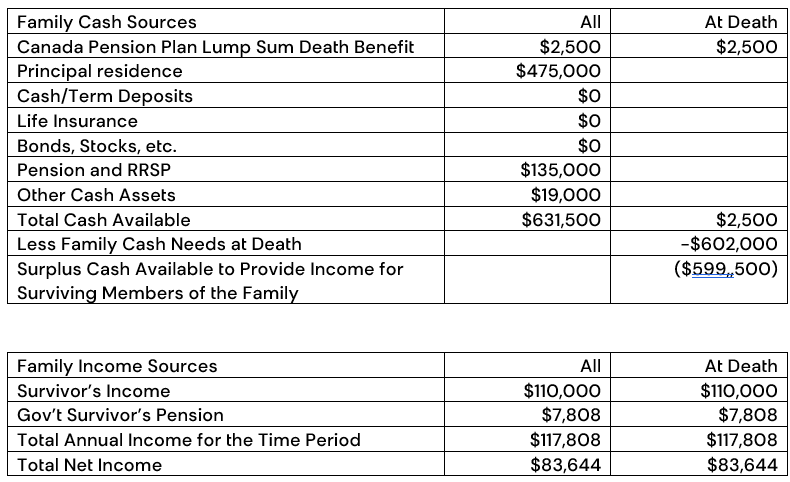

Family Cash Sources

In the event of a death, the remaining members of the Forrester’s family will face two financial needs: liquid cash, and income. Some cash needs are temporary; others are required at all stages of life.

The Forrester’s cash and income requirements look like this:

Given the current family income of $177,000, and given the Forrester’s desire to maintain their present standard of living, the following annual after-tax income is desired:

For the period during which more income is required: $96,262

For the survivor thereafter: $64,175

Step one in WealthCo’s three-step approach involves a frank conversation about their wishes in the event of death or disability, during which Chris and Jennifer shared their key priorities:

- A desire to pay off their debt;

- A nest egg to supplement any lost income; and

- A legacy for their children to cover educational costs.

Next, we look at what things would look like in the event of a death.

Given the desired after-tax annual income of $96,262 this amounts to an annual income shortfall of $12,618.

Then we calculate the additional, income-producing capital (life insurance) needed to solve this income shortfall for the survivor’s normal life expectancy (which is age 88).

This comes to $1,856,286.

Their advisor then considered Chris and Jennifer’s current employment insurance situations. Chris has a solid benefits plan which includes excellent coverage for disability insurance. On the other hand, Jennifer is self-employed and is the primary breadwinner, and is without employer-provided insurance.

Given this, and based on a needs analysis, their advisor recommended the following approach:

- $600,000 of permanent insurance for needs through retirement, plus $325,000 of Term-20 on Chris, plus $1 million of Term-20 on Jennifer – the cost of these premiums come to $615/month

- Given that Jennifer is self-employed, disability insurance of $4,300 per month (which equates to two-thirds of her after-tax income, the maximum available) until the age of 65 is also recommended (this coverage costs $258/month)

- Critical illness is also an option, coverage of $100,000 each would come to $166/month

Given that life insurance and disability insurance are the priority coverages and fit within their budget, the Forrester’s decide to proceed with those coverages, giving them much-needed peace of mind knowing that their family is financially protected in the event of premature death.

Give yourself that same peace of mind by scheduling your personal risk review.

Please note, this scenario is for general information purposes and should not be taken as legal, accounting, taxation, or actuarial advice.

Related Posts