2021 was quite a year. From the January 6th deadly capitol insurrection across the border to COP26 which shone a light on the need for increased climate action to the Omicron variant that pushed Canada into its fourth wave of the ongoing COVID-19 pandemic. It bears repeating that 2021 was quite a year. It’s therefore not surprising that a year like that would also include a great deal of market volatility.

“In spite of all of this, we saw North American markets actually perform quite well,” Stephen Logan, WealthCo Senior Financial Analyst, points out. “2021 saw the S&P hitting record highs 71 times throughout the course of the year.”

Whereas unprecedented was the 2020 people’s choice word of the year (as decreed by Dictionary.com), the Financial Times has identified transitory as the 2021 word of the year. Given that Merriam-Webster defines transitory is ‘of brief duration’ and ‘not persistent’, this points to an environment in which change is inevitable.

Key Factors in Last Year’s Market Volatility

Here we consider some of the key factors that contributed to 2021’s market volatility.

Inflation

Logan points to inflation as being a huge factor in the volatility that we experienced in 2021, as well as being responsible for the heightened use of that 2021 word of the year, transitory.

“The most recent inflation report that came out showed that Canada's inflation rate was at 4.7% (highest rate since 1991). And the United States was at 7% (highest rate in almost 40 years). This was largely driven by the labor market recovery, by people making more income again, and by the supply chain disruptions that are increasing the costs of goods transportation.”

Furthermore, with record low interest rates, borrowing money becomes a more attractive proposition. Both for businesses, who may jump at the chance to finance new projects, and for consumers who might consider large-scale purchases that might otherwise give them pause (ahem, real estate). It is widely anticipated that central bank rates will increase in the near future in order to curb some of this inflationary activity.

Supply Chain Issues

Who can forget the images of the container ship that blocked the Suez Canal for six days in March 2021, resulting in losses of $400 million per hour? This meme-inducing event was just the tip of the iceberg for 2021 supply-demand imbalances. COVID-induced factory closures, port congestions, weather disruptions, truck driver shortages, and pent-up demand also piled on resulting in global shipping cost surges.

Amateur Day Traders

When you take away movie theatres, restaurants, sporting events, live music…the masses get restless and look for alternate ways to fill that time. And many, since the start of the pandemic, have started to fill that time with day trading.

“In 2021 we also saw a huge increase in retail investors and the meme stock trend,” Logan recalls. “Having these amateur investors hop on the securities bandwagon to try to make some quick gains without having the investment expertise and know-how certainly contributed to market uneasiness.”

Rising Energy Prices

Oilprice.com reports that energy prices rose by 59% last year, compared with an average 20% increase in other commodities on the S&P Goldman Sachs Commodity Index. In October, West Texas Intermediate crude futures hit its highest level since 2014 (over $80 per barrel). Europe, in particular, has felt the impacts of these rising energy costs.

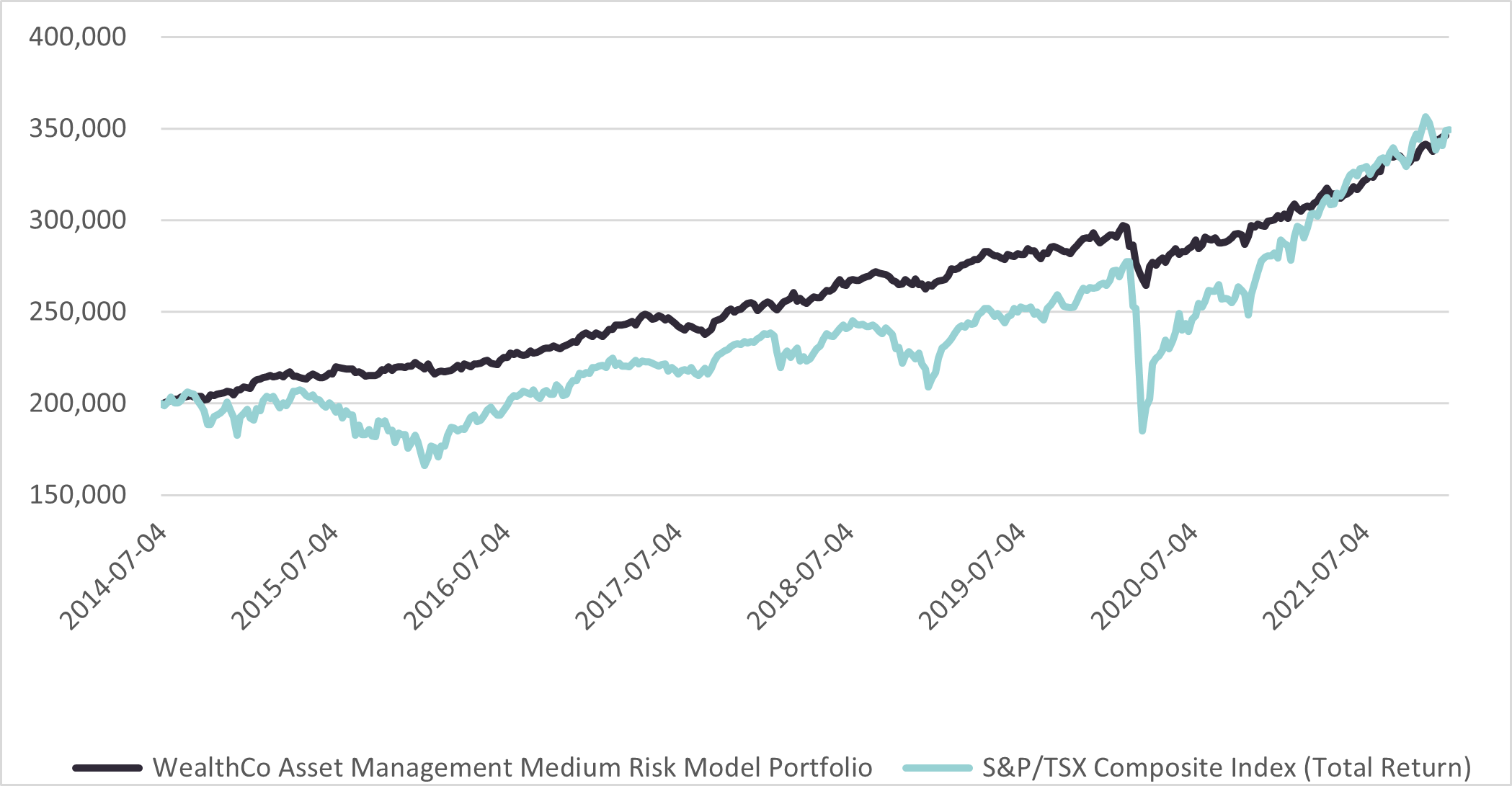

How Our Funds Performed in 2021

Our balanced portfolio had a very strong year – to the tune of 15.32% in returns. Here we dig deeper into how each of our four funds performed in 2021.

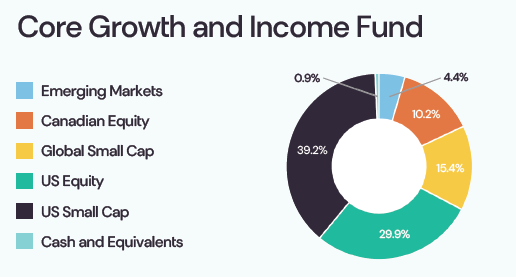

Core Growth and Income Fund

Mandate: The Core Growth and Income Fund invests in global equities of varying market capitalizations, with a strong focus on acquiring investments in companies with proven business models, low-to-moderate leverage, and the ability to pay dividends.

Our Core Growth and Income Fund had a banner year, delivering 24.44% returns. Given that our benchmark fund, the All Country World Index, returned 18.38%, we’re thrilled to have exceeded this quite significantly. This despite a bit of a downtrend in the emerging markets sector as a result of Evergrande, China's second largest real estate manager, going into default which resulted in some market turmoil.

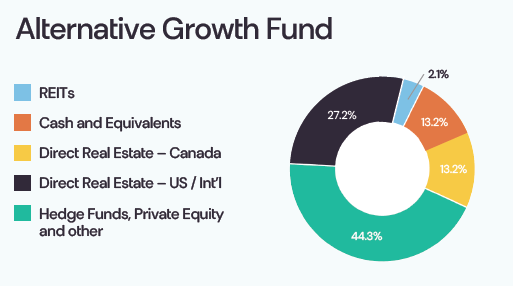

Alternative Growth Fund

Mandate: The Alternative Growth Fund generates capital gains from private and non-traditional real estate investments, including real estate investment trusts, direct real estate holdings, private equity, hedge funds, and other alternative strategies.

Coming in just behind our Core Growth and Income Fund was our Alternative Growth Fund which delivered 22.81% in returns. This year saw a couple of fantastic additions to the pool, including the Starwood distressed opportunities fund and Avesi, a private equity group focused on mid-market buyout in the healthcare sector.

Worth noting with the Alternative Growth Fund, a lot of the returns realized here this past year was from investments that we made two - three years ago. We tend to see less immediate returns in this fund, and longer hold periods, and we’re hoping to see that a lot of the great investments we made in 2021 paying dividends in the coming years.

Two investments that were made a few years ago had strong performing exits in 2021 – Star Metal Residences and Spartan Ridge Industrial.

Star Metal Residences is the first-to-market, luxury, hi-tech multifamily offering in West Midtown Atlanta. WealthCo initially invested in Star Metal in 2018. It took two years for the property to be fully developed, and the liquidity event earned us a gross internal rate of return (IRR) of 16.37% and a gross multiple on invested capital (MOIC) of 1.63x.

Spartan Ridge Industrial is a distribution and warehousing facility strategically located between Atlanta and Charlottetown. Similar to Star Metal, WealthCo invested in the development in 2018, and our recent exit earned gross IRR of 36.91% and a gross MOIC of 2.48x.

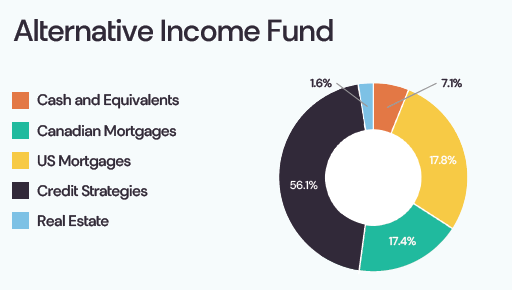

Alternative Income Fund

Mandate: The Alternative Income Fund invests in alternative credit investments in order to earn superior rates of return vs the traditional bond market. This includes private mortgages, bonds issued by private companies, and other interest-earning vehicles.

In this fund, WealthCo has invested approximately 50% in real estate assets, as real estate is a great inflation hedge. In terms of our portfolio construction for our clients, we currently have a higher allocation into alternative income than we do in our fixed income securities, including Canadian mortgages, corporate credit, and a variety of other private lending strategies. This fund delivered returns of 7.71% last year.

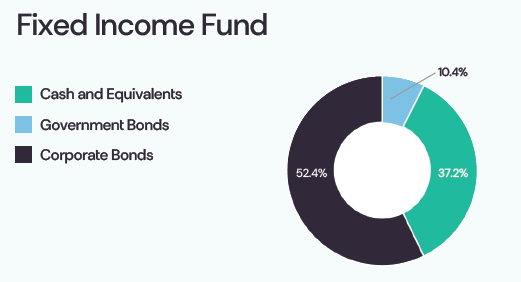

Fixed Income Fund

Mandate: The Fixed Income Fund provides exposure to North American investment grade fixed income by holding high quality government and corporate bonds.

Here again, we have outperformed our benchmark (which is XBB.TO, iShares Canadian Universe Bond EFT), returning -1.18% vs its -5.10%. We have allocated more into alternative income than in fixed income securities because there is a higher opportunity to capture excess yield in those securities, while they also tend to have a very high credit quality. Consider a triple A corporate bond; the average yield is currently at 2.5% Compared against 4.7% inflation in Canada. We have opted against investing there since the purchasing power of the dollar is reducing at a higher rate than the bonds are yielding. We are also keeping our fixed income portfolio lower duration than the benchmark, as duration is a better measure of bond price sensitivity to changing interest rates.

The WealthCo Competitive Advantage

Best-in-class partners

The WealthCo business model is built on a manager of managers philosophy. What this means is that we find world-class, highly reputable investment managers who are specialists in their area of expertise and look to them to provide us with deal flow and insights that we would not otherwise have access to.

As Logan points out, “in these times of extreme market noise, these world-class partners help us to filter out this noise and give us a tremendous competitive advantage.”

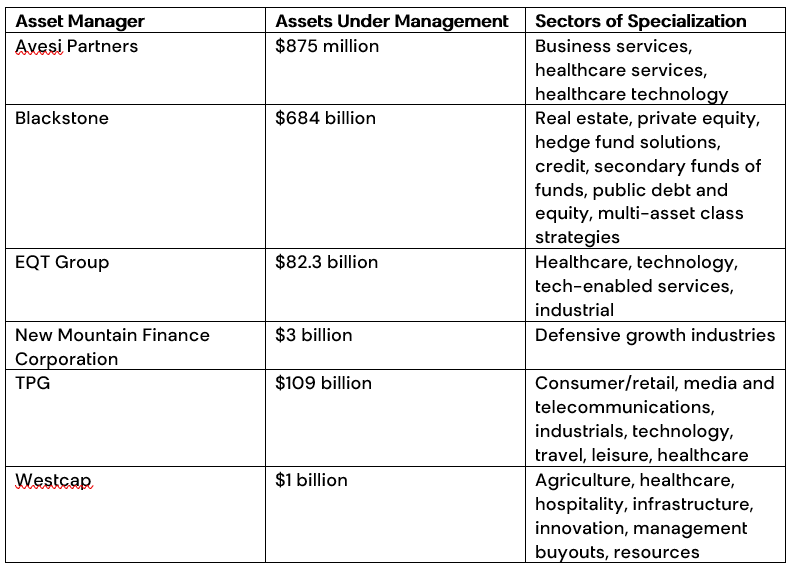

New Asset Managers

In 2021 alone, WealthCo added 13 new asset managers. These managers include the world’s largest private equity manager, Blackstone, and collectively our partners manage well over $1 trillion in assets.

Here is a bit more information on some of our newly-added asset managers.

A commitment to diversification

There has never been a better time to be looking at ways to diversify outside of the stocks and bonds market. “Last year, the lion’s share of retail investor returns once again were generated through the equity markets,” WealthCo Founder and CEO David Udy shares. “Equities should continue to play a role in a diversified portfolio but significant allocations into asset classes that have historically performed more favorably in times of inflation such as real estate, private equity, and floating rate debt is a key to mitigating downside risk. We continue our disciplined approach of focused diversification in order to protect our client portfolios from issues we potentially see evolving in 2022, like inflation and higher interest rates.”

In Closing

We would like to thank all of our clients and trusted partners who referred friends, family, and business associates to WealthCo over the past year. WealthCo continues to grow and build an increasingly larger pool of capital for investments, due in large part to your support. During volatile times like these, professional portfolio advice can make a huge difference. If you’d like to schedule a portfolio review, or if you know of someone in your inner circle who could benefit from a review, please reach out or talk to your financial planner or CPA.

Related Posts